Algo Trading Bridge – Seamless API Integration for Automated Trading

Algo Trading Bridge – Connect Your Strategies to Broker APIs

What Is an Algo Trading Bridge?

An Algo Trading Bridge is a software solution that connects your trading strategies to brokerage platforms using APIs. This allows real-time order execution, trade management, and automation without manual intervention.

We provide only the Algo Trading Bridge – strategy Ideas are handled by the client. Our bridge ensures a fast, reliable, and efficient connection between your custom-built strategies and your preferred broker.

Why Do You Need an Algo Trading Bridge?

Seamless Execution

Connect your strategies built in Amibroker, MT4, TradingView, Python, or other platforms directly to the broker’s API for real-time execution.

Broker API Compatibility

Our bridge supports leading brokers providing API access, ensuring smooth order placement and management.

Zero Manual Intervention

Trade with full automation, eliminating execution delays and manual errors.

Lightning-Fast Processing

Experience low-latency execution for high-frequency trading (HFT) and scalping strategies.

Robust Risk Management

Our bridge supports position sizing, stop-loss, target management, and more for risk control.

Features of Our Algo Trading Bridge

Multi-Platform Strategy Compatibility

Supports execution from Amibroker, MetaTrader (MT4/MT5), TradingView, Python, Excel, and more.

Real-Time API-Based Execution

Connects directly with broker APIs for instant order execution.

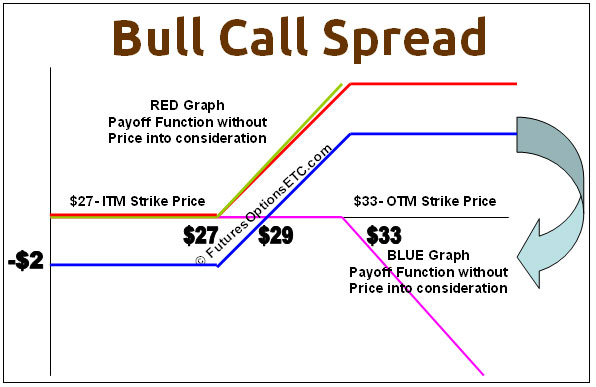

Supports Multiple Order Types

Market orders, limit orders, stop-loss orders, trailing stops, bracket orders, and OCO (One Cancels Other).

Secure & Reliable

Built with secure encryption and failover protection to prevent execution errors.

Live Market Support

We provide support during market hours to assist with execution issues.

Customizable & Scalable

Designed to handle retail traders, prop firms, and institutional clients with custom API configurations.

How Our Algo Trading Bridge Works

- Client Develops the Trading Strategy (in Amibroker, MT4, TradingView, Python, etc.)

- Our Bridge Connects the Strategy to the Broker API

- Live Orders Are Placed Automatically Based on Signals

- Trade Execution, Position Monitoring & Risk Management

- Client Manages and Optimizes Their Strategy Continuously

Who Can Use Our Algo Trading Bridge?

- Retail Traders – Automate strategies without coding broker integration.

- Proprietary Trading Firms – Execute high-frequency and low-latency trades efficiently.

- Institutional Investors – Connect quantitative models to trading platforms.

- Brokers & Sub-Brokers – Offer algorithmic execution solutions to clients.

Why Choose Us for Your Algo Trading Bridge?

- 100% API-Based Execution – No third-party dependency.

- Compatible with Multiple Brokers – Works with major brokerage APIs.

- Low-Latency & High-Speed – Ideal for HFT and algo trading.

- Real-Time Support During Market Hours – Get assistance when needed.

- Scalable for All Traders – From retail traders to institutions.

Frequently Asked Questions (FAQs)

No, we only provide the Algo Trading Bridge. Clients must develop their own strategies.

We support all major brokers offering API access. Contact us for a compatibility check.

Yes, our bridge can execute orders based on TradingView webhook alerts.

No, if your strategy is already developed, our bridge connects it seamlessly.

We offer flexible pricing plans. Contact us for details.

Get Started with Our Algo Trading Bridge Today!

If you're looking for a reliable, high-speed Algo Trading Bridge, we’ve got you covered. Connect your trading strategies to broker APIs and experience seamless automated trading.

Contact us now to discuss your requirements!