Equity Intraday Strategies

Algorithmic trading is the future of fintech, and with robotrader, you can get in on the action! Our platform allows you to execute trades automatically according to predefined strategies, so you can rest easy knowing your money is in good hands.

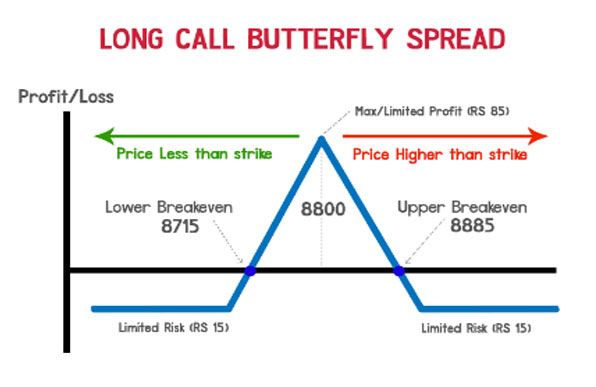

LONG CALL BUTTERFLY Development

The investor is looking for a low-cost, low-risk strategy that offers good potential rewards. A long butterfly is similar to a short straddle, except your losses are limited. This can be a great way to make money in a volatile market without taking on too much risk. By selling 2 ATM calls and buying 1 ITM call and 1 OTM call, the investor can benefit from price movement in either direction.

After doing some research, he found a strategy that offered a good risk / reward ratio, as well as low cost. A long butterfly, similar to a short straddle, could give him the profits he was looking for. He sold 2 ATM calls, bought 1 ITM call, and bought 1 OTM call options (with equidistance between the strike prices). This would limit his losses if the stock price stayed stagnant or decreased slightly. And if the stock price increased past the strike prices of any of the options he had sold, he would make a profit.

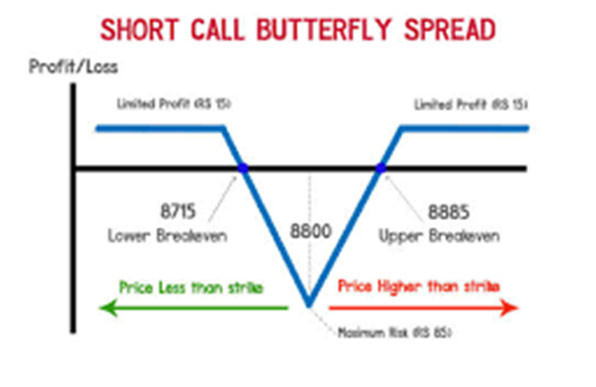

SHORT CALL BUTTERFLY Development

I'm a trader who specializes in the Short Call Butterfly. It's a great strategy that can be profitable in case of a big move in the stock or index.

Recently, I was approached by one of my clients with an interesting opportunity. He had noticed that his company's stock was starting to move higher, and he wanted to take advantage of it.

He asked me to construct a Short Call Butterfly for him. I was happy to oblige! We agreed on strike prices that would give us a net credit, and I got to work.

The trade went through without any problems, and we were able to profit from the stock's upward movement. Thanks for giving me the chance to share my trading strategy withYou've probably heard of the butterfly trade before, but what you may not know is that there's a special kind of butterfly trade called the short call butterfly. This strategy can be profitable in case of a big move in the stock or index, and it's surprisingly easy to set up.

Here's how it works: you sell one lower striking in-the-money call, buy two at-the-money calls, and sell another higher strike out-of-the-money call. This gives you a net credit (meaning you earn money upfront), and as long as the stock or index moves in the right direction, you'll make a profit.

So why not give this strategy a try? It could be just what

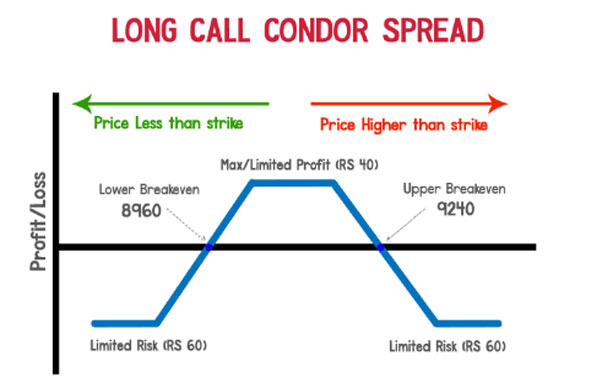

LONG CALL CONDOR Development

BUY 1 ITM CALL OPTION (LOWER STRIKE), SELL 1 ITM CALL OPTION (LOWER MIDDLE), SELL 1 OTM CALL OPTION (HIGHER MIDDLE), BUY 1 OTM CALL OPTION (HIGHER STRIKE)

The strategy is perfect for a range-bound market. The Long Call Condor involves buying an ITM call, selling an ITM call, selling an OTM call, and buying an OTM call. This setup ensures that the risk is capped on both sides, making it a safe bet in today's market. And the best part? The position is profitable if the stock or index remains range-bound. So why wait? Try out this strategy today!

You're sitting at your computer, scrolling through your options trading screen when you see a long call condor. You've heard about this strategy before, but you're not quite sure what it is. After reading through the description, you decide to give it a try.

You buy an ITM call option with a lower strike price, and then sell an ITM call option with a lower middle strike price. You also sell an OTM call option with a higher middle strike price, and finally buy an OTM call option with a higher strike price.

The goal of this strategy is to profit if the stock or index remains range bound. If the stock moves out of the range, however, your losses will be limited

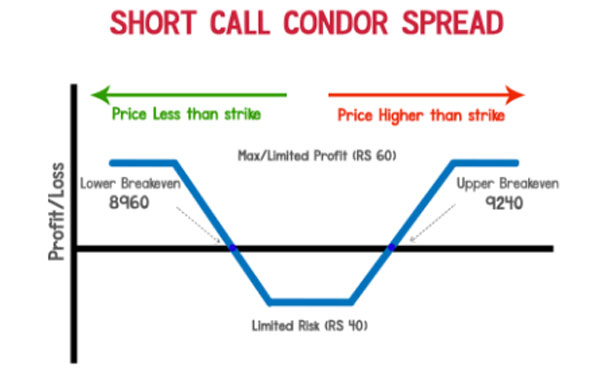

SHORT CALL CONDOR Development

SHORT 1 ITM CALL OPTION (LOWER STRIKE), LONG 1 ITM CALL OPTION (LOWER MIDDLE), LONG 1 OTM CALL OPTION (HIGHER MIDDLE), SHORT 1 OTM CALL OPTION (HIGHER STRIKE).

When it comes to volatile markets, there's no strategy as versatile as the Short Call Condor. This approach involves selling a lower strike call option, buying a lower middle strike call option, buying a higher middle strike call option, and selling a higher strike call option. As you can imagine, this setup is profitable if the stock or index experiences big moves in either direction.

Of course, with any strategy there are risks involved. But if you're comfortable with volatility and are confident in your analysis of the market, then the Short Call Condor could be right for you!

When volatility is high, this strategy can be very profitable. By selling an ITM call and buying two OTM calls, you create a position that profits from a big move in the stock or index. If the market moves in the right direction, this strategy can make you a lot of money. So if you're looking to make some serious profits in a volatile market, then Short Call Condor is the strategy for you!