LME Data with TradingView – Mean Reversion Algo Trading

Automate LME Metal Trading with TradingView & API Execution

Are you looking to trade LME (London Metal Exchange) metals with TradingView using an automated strategy? We develop custom algo trading solutions that integrate LME data, TradingView mean reversion strategies, and broker API execution.

Why Trade LME Metals?

The London Metal Exchange (LME) is the world's largest marketplace for industrial metals, including:

- Copper (LME Copper) – Essential for electrical and construction industries.

- Aluminum (LME Aluminium) – Widely used in manufacturing and packaging.

- Nickel (LME Nickel) – Critical for batteries and stainless steel production.

- Zinc, Lead & Tin – Used in automotive, aerospace, and industrial applications.

LME prices impact global markets, commodities, and forex, making them ideal for algo trading.

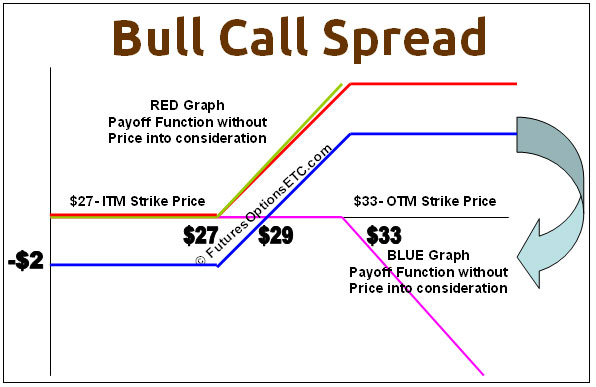

What is the Mean Reversion Trading Strategy?

A mean reversion strategy assumes that asset prices move away from their mean (average) but eventually revert back. This approach works best in range-bound markets.

Steps in Mean Reversion Trading:

- Identify overbought/oversold metals using Bollinger Bands, RSI, or Moving Averages.

- Wait for a price deviation (e.g., 2 standard deviations away from the mean).

- Place buy orders when price drops below the lower band, and sell orders when price rises above the upper band.

- Exit when price returns to the mean level.

Example:

- LME Copper price surges to $10,500, well above its 50-day moving average of $9,800.

- RSI hits 80 (overbought) – A sell signal is generated.

- Price drops to $9,800, and the short position is closed for a profit.

Advantages of Mean Reversion Algo Trading:

- Works best in sideways or ranging markets.

- High-frequency trading (HFT) friendly.

- Automated execution via broker APIs.

Our LME Trading Automation Services

We provide custom algo trading solutions for LME traders, institutional investors, and prop firms.

LME Data Integration with TradingView

- Real-time & historical LME price data integration.

- Live metal market analysis using Pine Script.

- Custom indicators & alert-based strategies.

Mean Reversion Algo Strategy Development

- Develop custom mean reversion models.

- Backtesting & optimization using Amibroker, TradingView, or Python.

- Risk management with stop-loss & position sizing.

Broker API Automation

- Auto-execute orders when TradingView alerts trigger signals.

- Integration with major global & Indian brokers (Interactive Brokers, Saxo Bank, Fyers, Zerodha, Dhan).

- Webhook-based execution for high-speed trading.

Why Choose Us for LME Algo Trading Solutions?

- Expertise in Algo Trading – 10+ years of experience in TradingView, Amibroker, MT4, MT5, and Python APIs.

- Custom Pine Script Development – Tailored indicators, strategies & automated trading bots.

- End-to-End Automation – From strategy coding to broker execution, we handle everything.

- Dedicated Support – Continuous monitoring, updates, and performance optimization.

Get Started with LME Trading Automation Today!

Want to automate your LME metal trading with TradingView & API execution? Let’s build a custom trading bot for you!

Contact Us Now to discuss your requirements!