Python to Broker API Automation – Seamless Trading Execution

What is Python to Broker API Automation?

Python is the most powerful language for algo trading, and with Broker API integration, you can fully automate trade execution without manual intervention.

Python-based trading bots can:

- Read live market data from broker APIs

- Analyze strategies & indicators for trading signals

- Execute orders automatically with high-speed APIs

- Manage risk, stop-loss, and take profit dynamically

This solution is ideal for retail traders, algo traders, hedge funds, and institutions looking to streamline trade execution.

Features of Python to Broker API Automation

Connect Python to Any Broker API

- Zerodha Kite API

- Upstox API

- Fyers API

- AngelOne SmartAPI

- AliceBlue ANT API

- Dhan API

Real-Time Market Data & Order Execution

- Fetch live market data, historical data, OHLC candles

- Place orders (Market, Limit, Stop-Loss, Bracket Orders) instantly

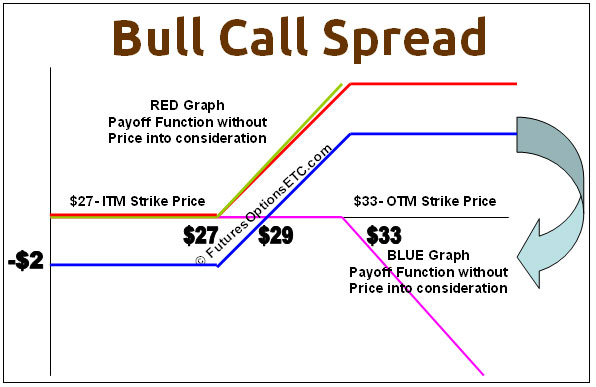

- Automate stocks, futures, options, forex, and crypto trading

Backtesting & Strategy Development

- Use Backtrader, Vectorbt, or custom Python models

- Test strategies before deploying them in real markets

- Optimize trading parameters for better accuracy

Smart Trade Execution & Risk Management

- Dynamic Position Sizing – Manage risk per trade

- Stop-Loss & Target Automation – Protect capital

- HFT (High-Frequency Trading) Support – For rapid execution

Custom Strategy Implementation

- Convert manual trading strategies into fully automated bots

- Use Python libraries like TA-Lib, Pandas, NumPy for analysis

- Automate trend-following, mean reversion, arbitrage, and scalping

Multi-Account Trading & Trade Copying

- Manage multiple accounts across different brokers

- Copy trades in multiple accounts simultaneously

Error Handling & Auto-Retry Mechanism

- Ensures order execution even during API failures

- Auto-retry for failed orders

Benefits of Python to Broker API Trading

Feature

- Speed

- Accuracy

- Scalability

- Multi-Account Trading

Manual Trading

- Delayed execution

- Prone to human errors

- Limited trades per day

- Limited

Python API Automation

- Instant & precise

- 100% algorithmic accuracy

- High-frequency trading

- Stocks, F&O, Forex, Crypto

Python trading bots execute trades 10X faster than humans!

Who Should Use Python Trading API Automation?

- Retail Traders – Automate your trading signals

- Algo Traders – Build high-speed bots

- Prop Firms & Fund Managers – Manage multiple accounts

- Hedge Funds – Execute large volumes seamlessly

Frequently Asked Questions (FAQs)

Yes, Python-based API trading is legal in India as long as you use exchange-approved broker APIs.

No! We provide fully developed Python scripts and a ready-to-use bot.

Yes! It supports equity, F&O, forex, and commodities.

Our bot includes auto-retry & error handling mechanisms to prevent failures.

We use encrypted API keys and secure execution servers to protect your data.

Automate Your Trading with Python API Today!

No More Manual Trading

100% Automated, Fast & Secure

Works with All Major Brokers